A major fashion retailer made headlines for a controversial decision that has ignited a social media storm.

The retailer deactivated thousands of customer accounts due to ‘high volumes of returns,’ banning them from shopping with the brand – forever. (It’s like a harsh break up!)

This action has left many of their customers feeling disheartened and disappointed, and from a CRM agency perspective, we know it’s easier to sell to existing customers than it is to acquire new ones so it raises the question, what were they thinking? In this blog, we’ll talk about why understanding LTV is important and what retailers could do better to handle returns without losing their loyal customers. (Because no one wants to feel like they have just been dumped!)

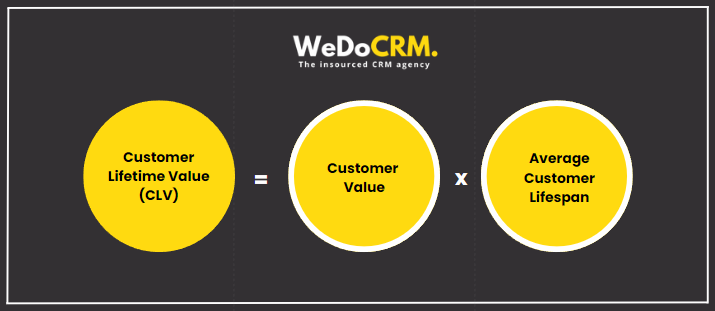

Understanding Customer Lifetime Value (LTV)

Customer lifetime value is the total worth a business can expect from a customer throughout the whole relationship with the brand. Instead of focusing solely on individual transaction values, it considers the potential of future transactions, providing an estimate of the overall revenue expected from that customer over time.

It’s a metric for making informed decisions about customer acquisition, retention and profits. If a customer has a high LTV, it reflects strong customer loyalty and shows your marketing and retention strategies are successful.

Understanding this helps your business balance the costs of acquiring and retaining customers against the revenue they generate.

How to calculate your LTV

The formula below is the standard formula that should help you.

To calculate yours, our partners at HubSpot have a Customer Service Metrics Calculator that you can use for free. Here, you can easily determine your business’s important metrics and KPIs for customer support, service, and success.

The costs of returns versus customer retention

Managing the costs of high return rates while keeping loyal customers is a tough balancing act for retailers. Returns can hurt profits through shipping and restocking costs, but harsh policies like banning frequent returners or charging return fees can push customers away.

What are the consequences?

- Reputational impact: Strategies like this can lead to negative public perception and backlash on social media, damaging a brand’s image.

- Decreased loyalty: Customers may lose trust in the brand, leading to diminished customer lifetime value and decreased loyalty.

- Long-term revenue losses: The potential for long-term revenue these customers could have generated is lost. This would be different if they felt valued and supported.

What can retailers could do differently?

At WeDoCRM our CRM services are tailored to help balance return costs with the potential long-term value of your customers, ensuring you maintain loyalty, protect your brand reputation, and maximise profitability. Managing returns isn’t just about minimising costs—it’s about valuing and nurturing customer relationships to build a sustainable and successful business. Here’s what we think they could have done differently.

1) Implementing Data-driven segmentation

Instead of an outright ban, retailers could use segmentation to manage high-return customers more effectively. By looking into customer behaviour and return patterns, they could have developed tailored strategies for different segments, such as:

The Frequent Returners: Offer personalised solutions like fit recommendations or previews of new collections.

The Inactive Customers: Engage with targeted offers and rebuild a positive relationship. Some customers were offended to be banned and felt insulted as they technically had done nothing wrong.

2) Understanding why return rates are so high

We would always encourage any brand to investigate the reasons behind the high return rates. Why are the items being returned? How can we adapt the processes to reduce this? Understanding the specific reasons, such as fit issues or quality can pinpoint areas for improvement.

3) Establishing a feedback loop

Creating a system for gathering and analysing customer feedback is essential for resolving issues. Consider conducting surveys that allow customers to share their thoughts and feel heard.

Retailers can learn valuable lessons by implementing effective return management strategies that avoid alienating customers. Focus on data-driven segmentation to understand return reasons and create feedback loops to boost customer satisfaction and retention.

Focus on increasing your current customer lifetime value of your existing customers, this is a great way to drive growth. If you rely too much on new customers, you might find you are spending a lot to get them.

By balancing return costs with the potential long-term value of customers, you can maintain loyalty, protect your brand reputation, and maximise profitability.

Ultimately, managing returns isn’t just about minimising costs—it’s about nurturing customer relationships to build a sustainable and successful business. Word of mouth and positive vibes are everything in this game!

How WeDoCRM can help you achieve retail success

WeDoCRM is a leading CRM agency, specialising in CRM and MarTech integrations and operations, as well as multi-channel marketing support. We work directly with CRM teams and organisations worldwide such as MoneySuperMarket, GoHenry, Ted Baker and Volvo to help them drive sustainable, recurring revenue.

Are you a retail brand looking for support in segmenting your audience?

Are you looking for support with feedback loops?

Are you looking for ways to keep return costs down while still nurturing your customer relationships?

Get in touch to discuss how our customised CRM services can drive growth and success for your business. Schedule a consultation today to explore the possibilities of our insourced model.